Former U.S. Treasury Secretary Lawrence Summers says an old school method of tracking inflation may reveal the real amount of economic pain that Americans have had to endure.

Summers has co-authored and released a new paper exploring the effect of high interest rates on the American consumer.

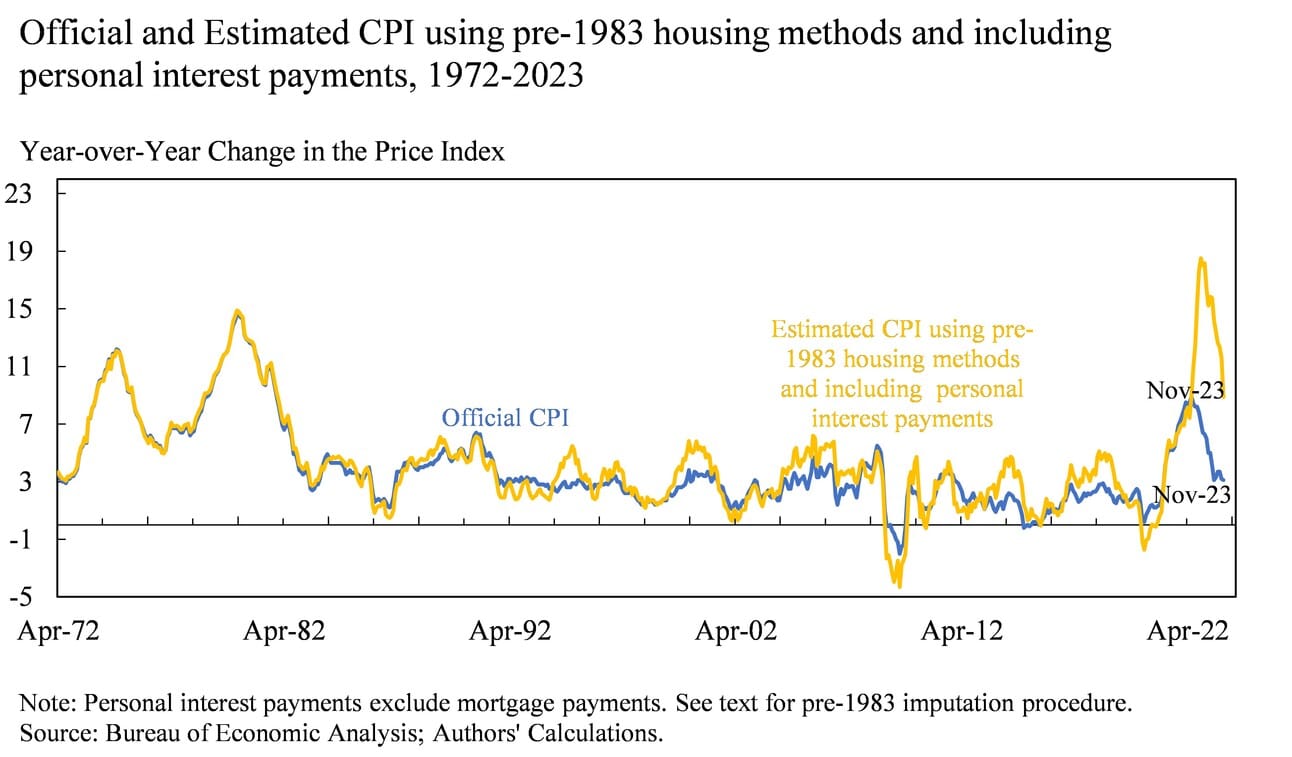

The paper, in part, aims to paint an alternate and more accurate view of inflation by incorporating economist Arthur Okun’s pre-1983 system of measuring inflation, which took into account personal interest rates and housing financing costs.

After 1983, those metrics were taken out of the consumer price index (CPI), which Summers and the authors of the paper argue may be giving an inaccurate portrayal of inflation in the US.

Using the pre-1983 method of measuring inflation, the report says that in November of 2022, CPI spiked by about 18% – contrary to the official 4.1% number determined by the government.

The new numbers paint a darker picture of the inflation that Americans are dealing with to this day, with the report stating the pre-1983 measure offers a “more worrying picture of inflation in the current moment than the official inflation numbers.”

Summers broke down the discrepancy via Twitter,

“Pre-1983, mortgage costs were in the CPI as were car payments pre-1998. Now, price indexes do not include borrowing costs. Thus, when interest rates jumped last year, official inflation did not fully capture the effects it would have on consumer well-being…

We show that if we make an effort to reconstruct the CPI of Okun’s era—which would have had inflation peak last year around 18%, we are able to explain 70% of the gap in consumer sentiment we saw last year.”

The revelation that inflation was likely much higher than reported may explain the discrepancy between the official numbers and the soaring cost of everyday expenses like groceries and housing.

Summers also notes that personal interest payments, which are not incorporated into the government’s CPI system, increased by more than 50% in 2023.

Summers and the co-authors of the paper also argue that the higher cost of borrowing has created a “deeply felt pain point” for consumers by putting the housing market in a “lock-in” state whereby homeowners are deterred from selling due to potentially higher mortgage payments on their next home, while underwhelming price drops aren’t enticing new buyers.

“The Federal Reserve’s rate hikes have pushed mortgage rates to two-decade highs while house prices have yet to come down towards pre-pandemic levels. The market is in stasis with both homeowners and would-be buyers reporting high levels of disappointment.”

The paper, titled “The Cost of Money is Part of the Cost of Living: New Evidence on the Consumer Sentiment Anomaly,” can be read here.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox Check Price ActionFollow us on X, Facebook and TelegramSurf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney