A new report from digital asset management firm CoinShares pulls data from several industry leaders to analyze the big crypto picture.

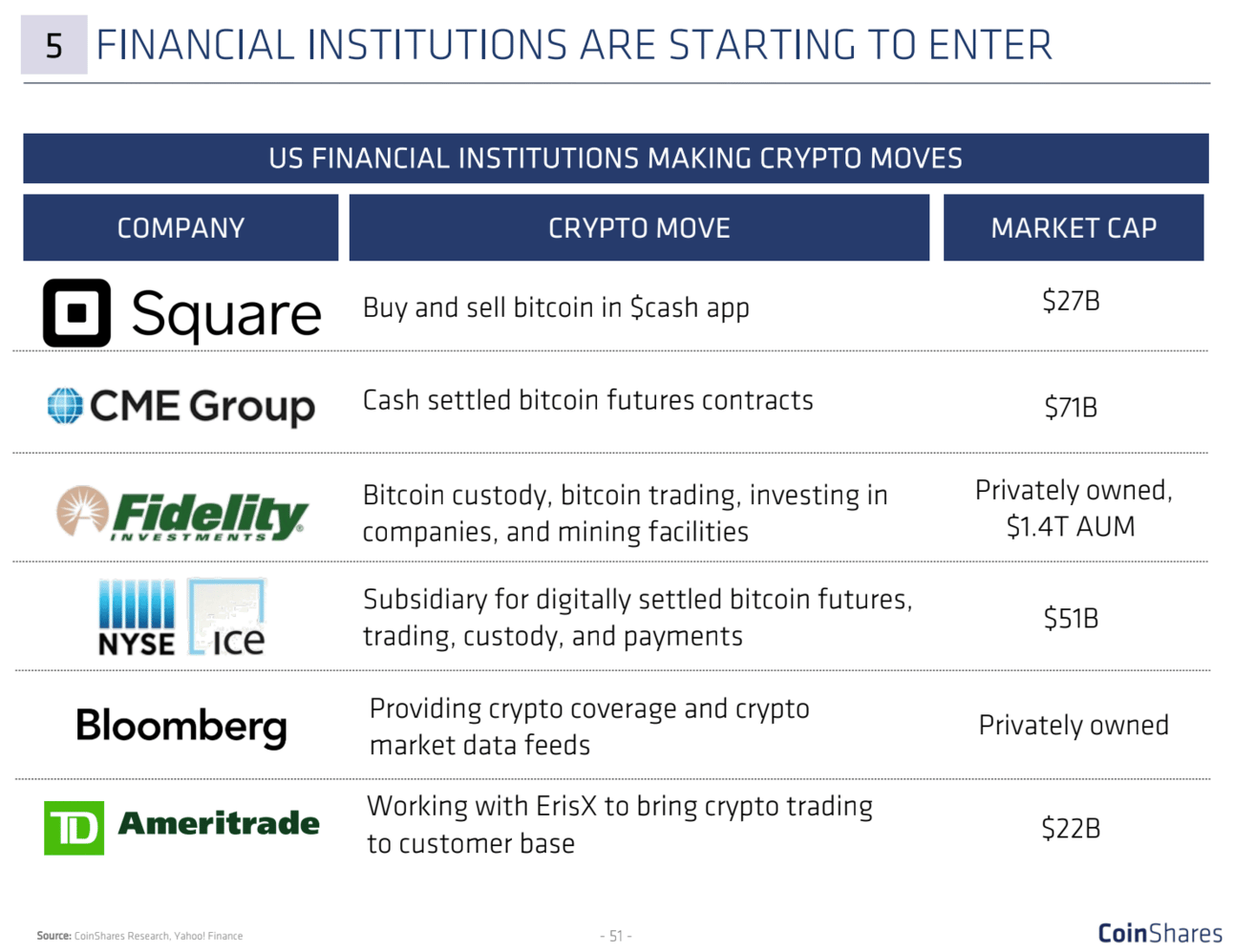

The results show that over the past 10 years since the launch of Bitcoin, the market is transitioning from “consumer” to “institutional”, opening new segments with major players.

The next evolutionary step for Bitcoin is expected to be “Bitcoin banking” with key services for clients – banking deposits, insurance, investment products, cross-border payments and sovereign currency. The timeline for this next phase is 2022 and beyond.

For consumers, Bitcoin promises more financial inclusion.

According to the report,

“Today, 3.8B people, or 50% of the world has access to the internet and 42% have access to a smart phone, and while many are participating in online communities, many users are still cut of from the global economy and financial access outside of the local areas where they reside.”

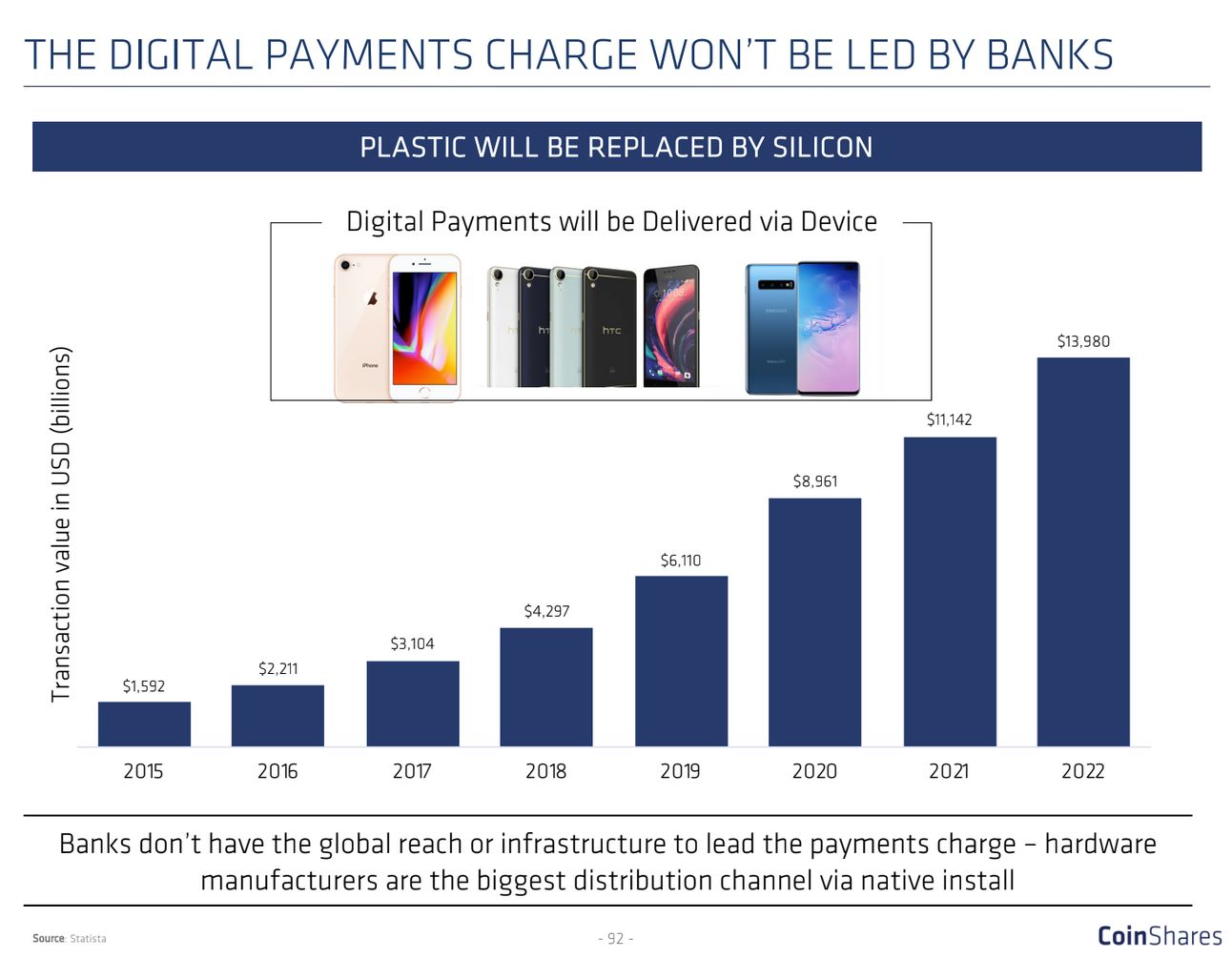

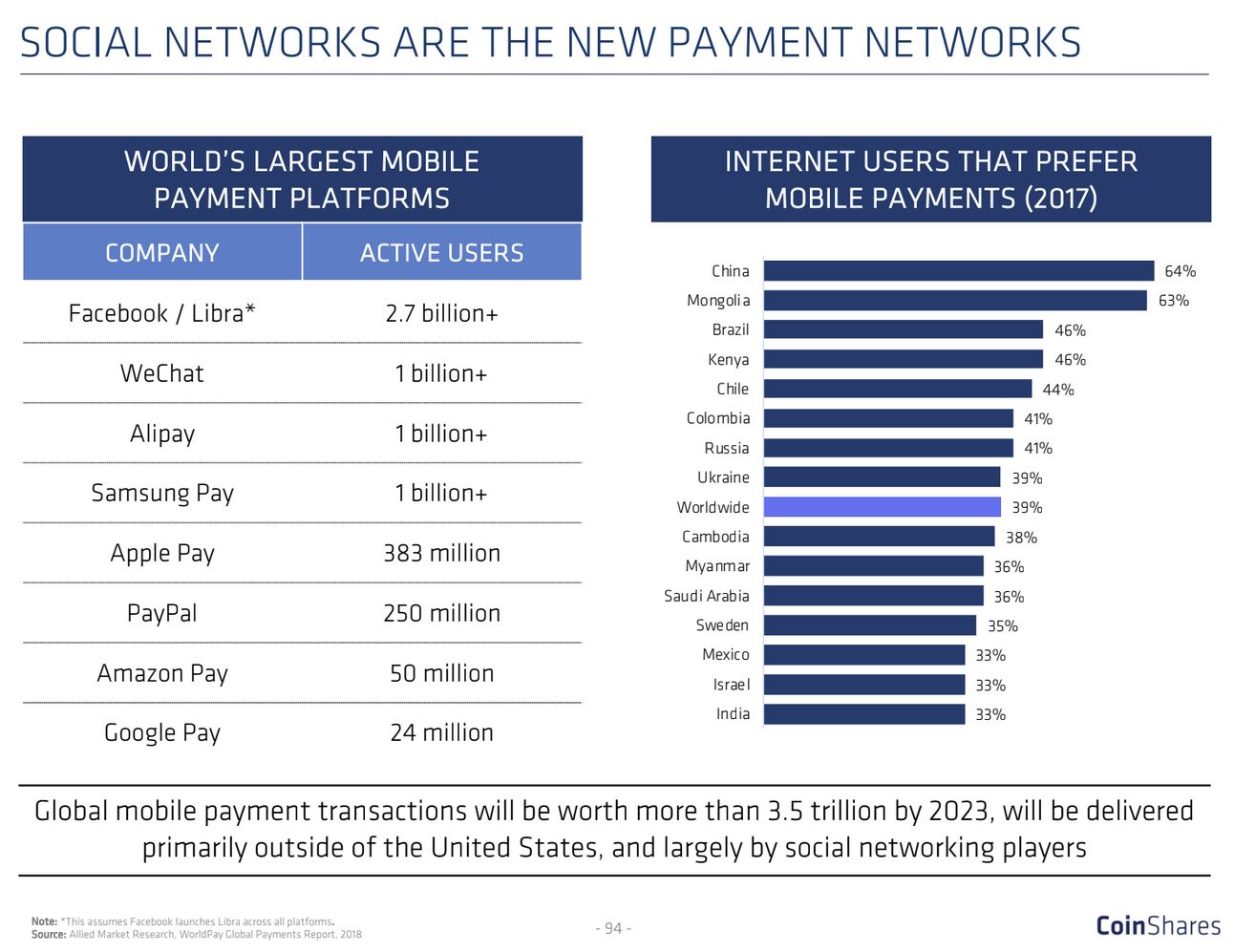

The digital reach for global payments won’t be driven by banks but by devices and social media platforms.

Major tech firms, from Facebook to Samsung to Alibaba, are expected to usher in a more pervasive digital economy as millennials align their on-demand and on-the-go habits with their money.

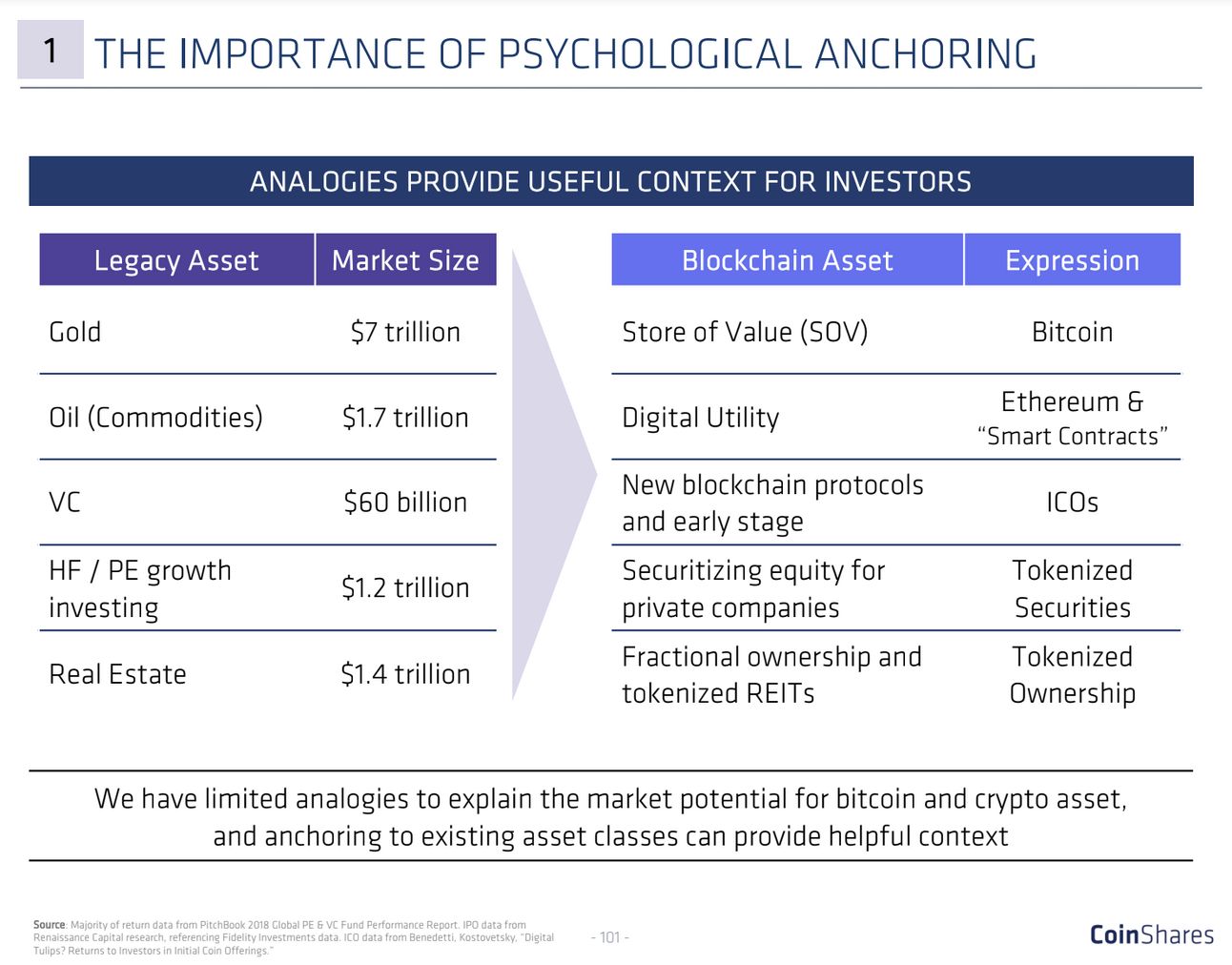

The expanding digital landscape is generating blockchain-based counterparts alongside traditional assets and legacy structures – with Bitcoin in the primary position.

“Comparatively, bitcoin has been volatile, but on an absolute basis, it’s outperformed every other asset class over a comparable time scale.”

The report underscores the notion that crypto is still in its early days, still has a steep learning curve and still requires more time before its core concepts catch on and consumer traction takes off, generating new opportunities.

“The internet did not kill companies. It enabled new types of companies to grow and made existing ones more agile and efficient.

Bitcoin and open financial systems will not kill financial institutions. It will enable new types of companies to grow and make existing ones more resilient.”

https://twitter.com/thehumanxp/status/1183032826809204736

CoinShares launched the world’s first regulated Bitcoin investment fund. You can check out the company’s full Crypto Trends Report here.