[the_ad id=”50945″]

Ripple chief technology officer David Schwartz is responding to a Bitcoin price warning from BTC investor and podcast host Brad Mills.

The cryptocurrency markets have rallied over the past two days, with Bitcoin rising from about $5,336 to $6,130 at time of publishing.

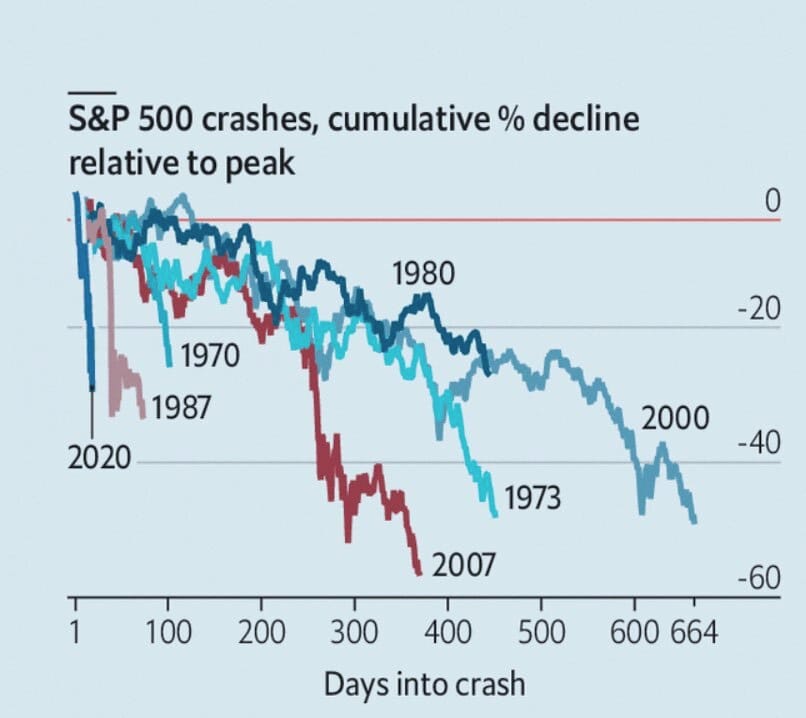

Despite the uptick, Mills says data from prior crashes suggests another major pullback in traditional markets is coming – one that will take another wrecking ball to Bitcoin.

“If you have not taken your money off the table yet, I don’t know what you’re waiting for. Monday is not going to look good. Likely all 3 circuit breakers will be hit sometime soon…

Yes, Bitcoin is going to get rekt badly once more before this is over. Thinking of selling more here.”

In response, Ripple’s Schwartz questions whether taking money off the table is a futile response, given potential weakness in bonds and the forex market.

Schwartz also questions the strength of banks, and whether it’s a smart move to hold assets in US dollars.

“If you take it off the table, where do you put it? Bond funds are also risky, money market may break the buck, are banks even safe?”

Mills says he thinks investors should hold a large cash position in the short term, spread across multiple banks to reduce risk.

“Heavy weight cash and deploy it conservatively; own different assets. Invested in things and businesses as the trend shifts, cash is temp. I’m slowly moving out and will slowly move back in so I don’t do any YOLO bets. Spread cash across multiple banks.”

Schwartz has been open about his status as an XRP investor. In April of last year, he also said he sold $40,000 worth of Ethereum (ETH) and plans to keep skin in the crypto game for the “foreseeable future.”

“The majority of our liquid assets is still XRP that I purchased on exchanges by market making. The majority of our illiquid assets is still Ripple stock. I’m going to have lots of skin in the game for the foreseeable future whether I want to or not.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

[the_ad id=”90130″]