In an interview with Bloomberg Intelligence’s Ben Elliott at the Bloomberg Sooner Than You Think technology summit on the outlook for cryptocurrencies, former U.S. Commodity Futures Trading Commissioner Sharon Bowen said she’s optimistic about the future of digital assets. As a current board member of the Intercontinental Exchange, the parent company of the New York Stock Exchange, which plans to launch cryptocurrency exchange Bakkt next month, Bowen says regulators have three primary concerns.

“I think there’s a major theme when regulators look at this. One, they want to make sure that their monetary supply and their currencies are not harmed by these virtual currencies. Two, they always want to protect their investors from fraud and manipulation. And three, they want to embrace innovation and technology. No one wants to be in the way of sort of stopping the next internet, but at the same time, it’s the right balance of embracing innovation but protecting.”

Regarding the launch of Bitcoin futures back in December 2017, Bowen said she expected prices to go down as transparency increased, and that the billions of dollars that fled the market was no doubt due, in part, to money that should not have been there.

The market, she believes, is still premature, leading to volatility and the very reasons why institutional investors haven’t yet fully embraced cryptocurrencies. But the former commissioner adds, “I think the fact that you’ve got every major bank, hedge fund, insurance company, retail company focused on this also says a lot.”

Elliott asked Bowen to address CFTC Chairman Giancarlo’s “light touch” approach and support for innovation. Bowen noted that immediately prior to her departure from the CFTC, she and her team launched the CFTC Lab to help analyze and understand digital assets and their underlying technologies, and to share regulatory concerns.

“I think that’s the right approach, frankly. It’s a lot better to know what you’re dealing with rather than waiting for the next crisis to then try to tackle the problem.”

“I don’t think that the Fed sees cryptocurrencies as being a threat or a systemic risk, if you will. I think the current administration and Treasury are very accommodative to innovation, and are asking for creative collaboration and cooperation.”

Bowen believes that “transparency is always the solution to a vibrant market” and that a comprehensive regulatory framework will happen, but says that “the jury is still out.”

The answers reveal that participants strongly believe cryptocurrencies are here to stay and expect them to rise as an asset class.

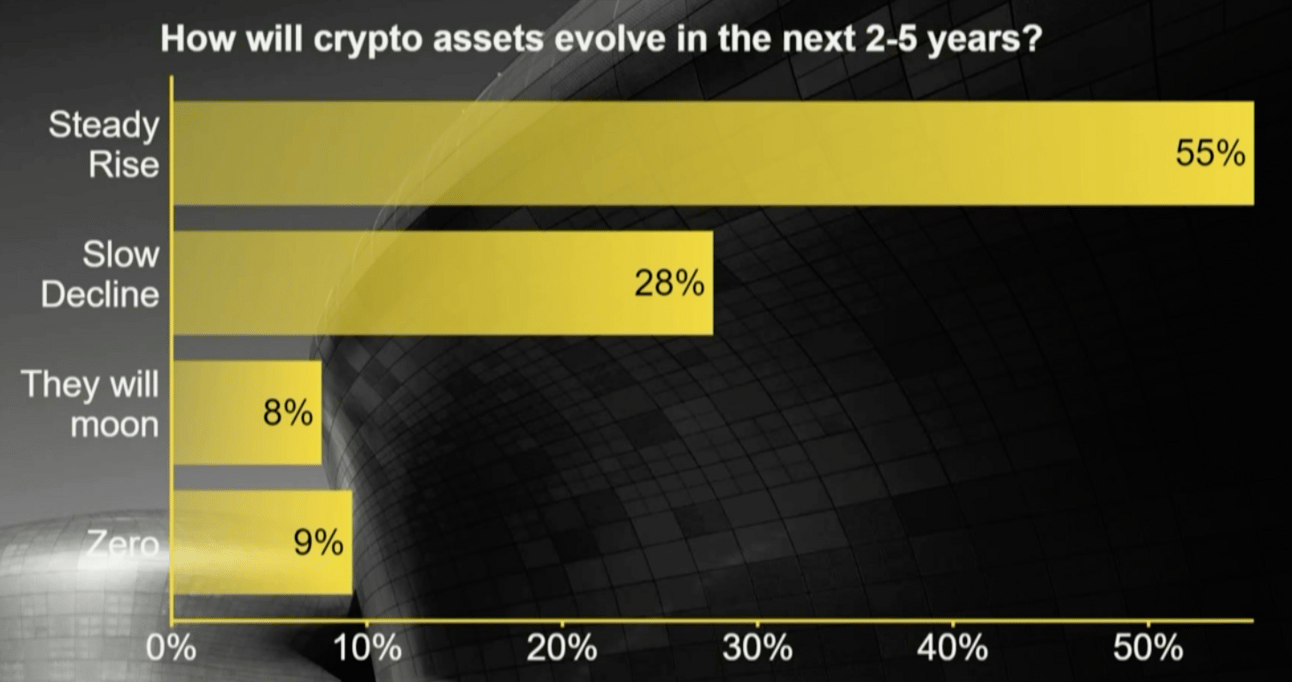

How do you see crypto assets evolving in the next two to five years?

Participants were overwhelmingly bullish with 55% predicting a steady rise.

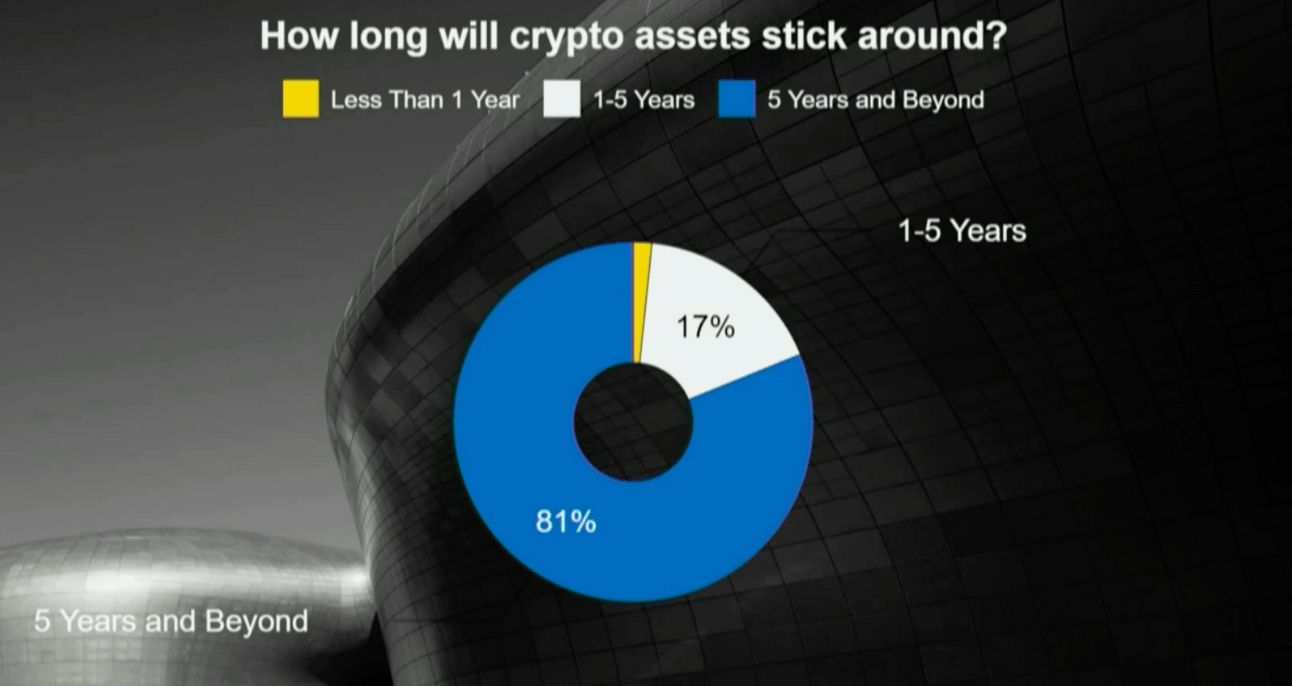

How long will crypto assets stick around?

Participants were even more bullish on this question with 81% of respondents predicting that crypto will be around for five years or longer.

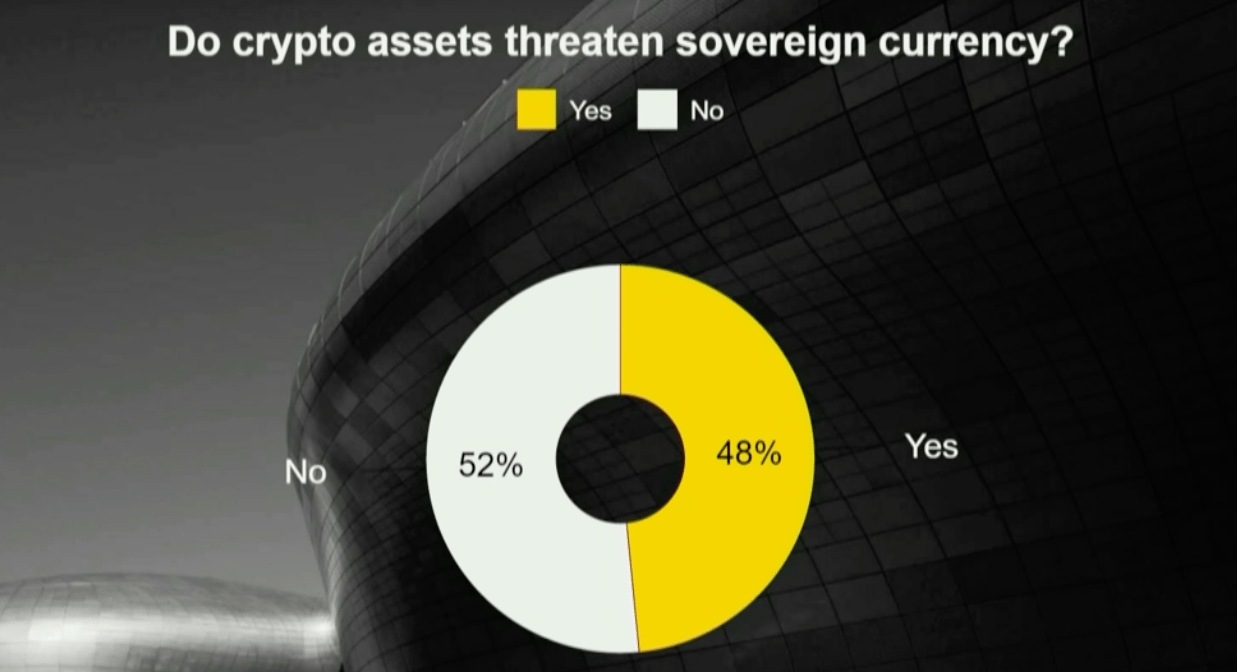

Do crypto assets threaten sovereign currency?

Participants were nearly evenly split.