[the_ad id="93550"]

As the global pandemic alters life as we know it, accelerating the work-from-home culture, shifting priorities and creating soaring demand for Zoom conferencing, fintech solutions are quickly encroaching on banks — the Blockbuster Video to their Netflix. The digital shift could trigger an $800 billion opportunity in the US equity market, according to global asset management firm ARK Investment Management.

Digital wallets, which are non-cash payments, allow people to make purchases through smartphones and other devices that can digitize payment information.

With on-demand offerings, cheaper fees and more efficient processing, fintech companies such as Square, Stripe and Venmo are powering digital wallets and positioning themselves as trusted players that can deliver mobile financial services using crisp, millennial-friendly interfaces, making legacy players look tethered to the last century.

Says Stripe CEO Patrick Collison via Twitter,

“Businesses launched on Stripe since lockdowns began in March have – somewhat incredibly – already generated more than $1 billion in aggregate revenue. We’re very glad to be able to play our part in helping them sell, adapt, and grow.”

Cathie Wood, founder of global asset management firm ARK Investment Management, adds,

“Innovation gains market share at an accelerated rate during tumultuous times: better, faster, cheaper, more productive, more creative!”

According to research conducted by ARK, the major shift in banking and financial services that’s driven by digital wallets will create a boon for fintechs over the next four years.

“In 2024, we expect more than 220 million digital wallet users in the US which, if valued like bank customers at maturity today, could represent an $800 billion opportunity in the US equity market.”

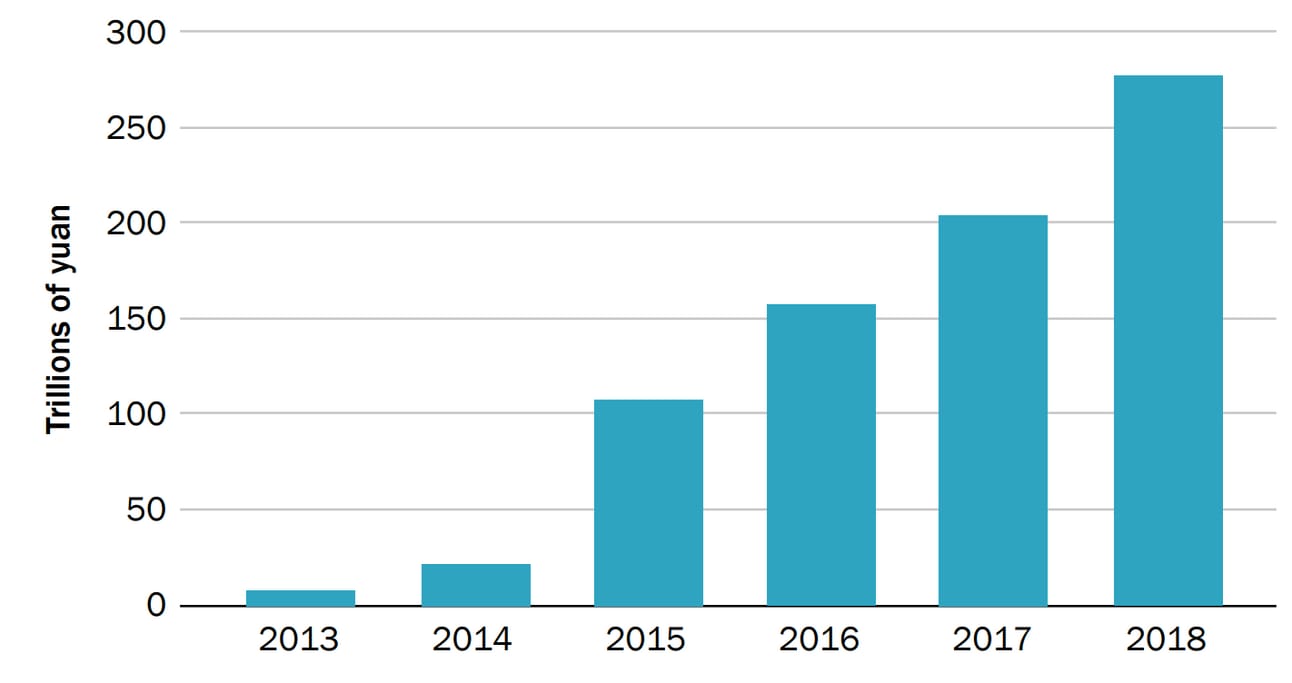

China has been leading the shift to digital wallets. Consumers in the world’s second-largest economy process more than 10 times the number of mobile payments than consumers in the US. Powered by Chinese tech giants WeChat and Alibaba, digital wallets in China are bundled with apps that give users a full slate of features, encompassing everything from restaurant bill splitting to managing balances to hailing taxi cabs.

China’s Digital Payments Revolution Mobile Payment Transaction Volume

China’s digital wallets are a look at how fintechs are able to diversify, moving beyond a finance-only model reserved for banking institutions. Instead, they can appeal directly to consumers and their daily shopping and spending habits by rapidly integrating other e-commerce platforms and offering digital discounts.

WeChat features in one app

Quick Pay for paying merchants

Sending money to friends and family

Tencent digital currencies to power payments in the ecosystem (i.e. gaming)

Go dutch for splitting bills

Ridesharing app access

Group buying coupons

Wealth management products

Tap to pay utility and phone bills

Access to website for clothing and skin care products

Access to deals via e-commerce giant JD

Integration of Starbucks and other big brands

Wood, who attended Rosenblatt’s 12th Annual Fintech Summit last week, highlighted a scenario where banks morph into utilities, as nimble fintechs swiftly leverage their ability to gain new customers cheaper – all while offering more, reports Forbes.

Regional banks that are investing $1,500 to onboard a new customer by using interest rates as carrot sticks, are competing against fintechs like Square and Venmo that can leverage a slew of rich features and perks to sign up a new user by investing about 20 bucks.

Says Wood,

“Square SQ Cash App and PayPal PYPL’s Venmo are evolving to the point where customers won’t have to use a traditional bank. Once they get their own bank charters they are going to run circles around the banks. That will hollow out banks and they will become more like utilities.”

The road to dominance for fintechs could be even faster than Facebook’s trajectory. As banks lose ground in the payments industry, usage of cash and credit cards is also slipping. According to research by Mordor Intelligence, mobile payments driven by digital wallets are expected to soar at a compound annual growth rate of 26.93% from 2020 to 2025.

Adds Wood,

“Cash app and Venmo are being adopted twice as fast as social networks like Facebook were being adopted back in the day … It’s taking one year to achieve the network effect that took two years in the early days of social media.”

Alipay is currently the world’s largest mobile payment platform with over 1.2 billion users.

[the_ad id="95413"]

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GaudiLab

The post Fintechs (Not Banks) Could Reap Windfall From $800 Billion Opportunity in US Equity Market appeared first on The Daily Hodl.