Enjin Coin Surges 153%

The price of Enjin Coin (ENJ) surged 153% in just over 24 hours after rumors surfaced that the company’s crypto wallet will be installed on Samsung’s Galaxy S10. The price is currently at $0.0962, up from $0.0362 little more than a day ago, according to CoinMarketCap.

The rumors came from Asia Crypto Today, which reported that anonymous Korean sources said Enjin’s Wallet “will be installed on Samsung phones used for sending of crypto assets.”

Binance CEO on XRP

Binance CEO Changpeng Zhao says XRP clearly has value based on its thriving user base alone. In response to a question on Twitter, Zhao said, “Decentralization idealism is good, but if you don’t have a project and user base to go with it, it is just idealism.”

It's simple my friend, as I answered in a few podcasts recently, one of the best ways to identify projects with value is the user base. Xrp got that.

The market votes with their feet, not decentralization idealism.

Increase your user base, increase adoption.

— CZ ? BNB (@cz_binance) February 26, 2019

Pantera Releases Look at Crypto Investments

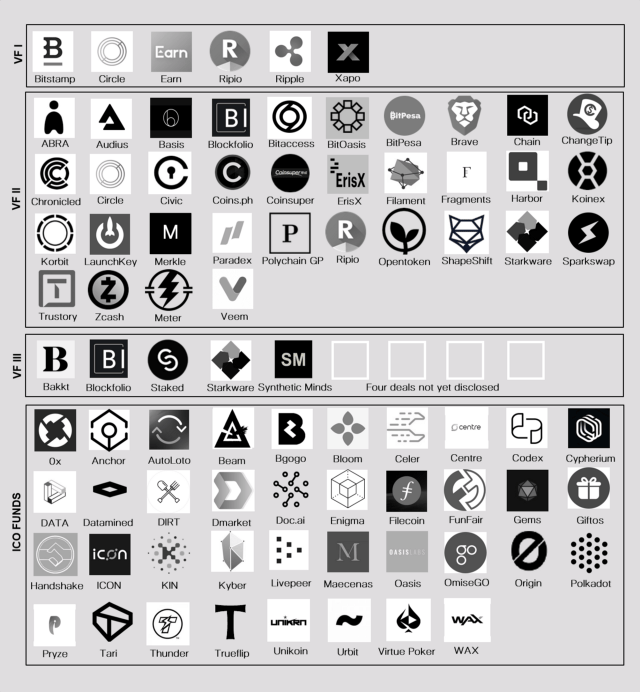

The crypto hedge fund Pantera just dropped an overview on its major investments in cryptocurrency and blockchain technology.

In an extensive update on the company’s movements in the space, Pantera highlights the 85 disclosed portfolio companies and protocol tokens it has invested in, including Bakkt, Bitstamp, Ripple, Xapo, ShapeShift, Brave, Zcash, 0x, Kyber, OmiseGo and more.

Says CEO Dan Morehead,

“We invest across the entire spectrum. We invest in pre-auction ICOs, liquid blockchains and venture.”

“Now the pendulum swung back to venture. In 2018, they did $19 billion of ICOs and only $4 billion of venture. I think 2019 is going to be the opposite: venture is going to be much bigger than ICOs.”