[the_ad id="93550"]

New on-chain data is offering an early look at the impact of the Bitcoin halving on miners that power the network.

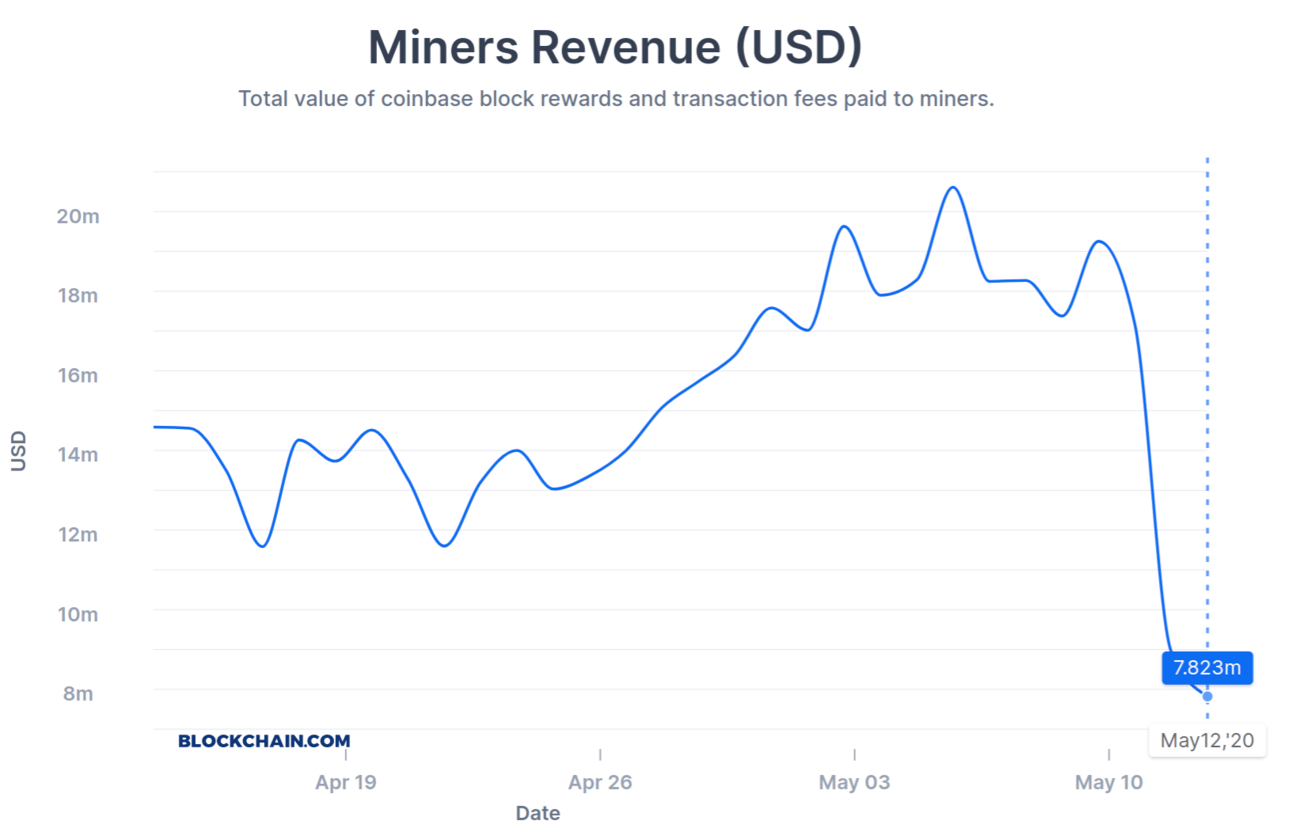

Immediately prior to the May 11th halving event, total miner revenue topped $17 million, according to data compiled by Blockchain.com, before plunging to $7.82 million.

On May 11th, the BTC reward for completing a block was reduced by 50% to 6.25 BTC, with revenue earned by miners instantly plunging 48%.

Increased pressure on miners has forced many to fold. Alejandro De La Torre, vice president at mining pool Poolin, speculates that a significant number of miners who comprise as much as 30% of the entire BTC network hash rate are struggling to turn a profit, largely due to running their operations on old and inefficient equipment, like Bitmain’s S9 miner.

De La Torre writes,

“While we expect most of these miners will shut down after the halving, it is likely that some of them have cheap enough electricity to survive in the near future.”

Chinese news outlet ChainDD reports that Wu Tong, deputy director of the CECBC Blockchain Special Committee of the Ministry of Commerce, expects miners to face steep competition amid higher industry consolidation.

“For Bitcoin mining industry, about 20%-40% of miners will close in the short term as the revenue calculated with the stable price is reduced. In the long run, with the arrival of the rainy season, the computing power will rebound and finally reach a relatively stable state. During this process, the small and medium-sized machines will inevitably shut down, and industry concentration will increase.”

Transaction fees are also soaring, up roughly 400% since the beginning of May and reaching their highest level since July of 2019, according to Bitinfocharts.

While miners suffer short-term pain, a post-halving spike in the price of Bitcoin could lead to increased revenue in the long run with more participants eventually rejoining the network.

Bitcoin is currently trading at $9,618, up 6.25% in the past 24 hours and up over 14% since hitting a 7-day low of $8,416 on May 11th. Ethereum is up nearly 2% at $199 and XRP is up 1.22% at $.2029, according to CoinMarketCap, amid a wide crypto rally.

Several other leading cryptocurrencies are posting gains on Thursday, including Bitcoin Cash, up 2.21%; Bitcoin SV, up 2.75%; Litecoin, up 1.93%; Binance Coin, up 1.38% and EOS, up 2.01%, at time of writing.

[the_ad id="95413"]

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GreenBelka