HodlX Guest Post Submit Your Post

BTC’s technical driven rebound has pushed the price of the leading cryptocurrency back to 7300 levels. While traders may wonder how far the bulls can go, there’s room for the bears to gain ground in the short-term. However, seasonal factors may come into play as markets approach the holiday season.

Return of the Bulls

The prices of Bitcoin made a sharp U-turn in the Thursday morning session in Asia, from below 6500 overnight to almost 7500 levels, before settling down in the 7200 area. While BTC bulls may still be cheering for the long due rebound, the price action could mainly be driven by technical factors.

CME Bitcoin futures has produced a gap earlier this week. It was located between 7120 to 7240. CME Bitcoin futures tend to fill the gaps, and we have seen many similar cases before. For example, the futures created three 3-hour gaps in November as the yellow circles indicate in figure 1, and all these gaps were ultimately filled. In addition to the oversold condition, we believe that the technical factor was the main driver of the rebound.

Figure 1: CME Bitcoin Futures 3-Hour Chart

Glass Half Full or Half Empty?

Despite the decisive turn in the market sentiment, it’s still premature to call Bitcoin’s price at this point, especially for the short term.

As of December 19th, the OKEx BTCUSD Index had a high of 7775.7 and a low of 6433.09, which means that the range so far has reached 1342.61, and that number is still below the average of 2772.326. Since the end of the so-called “Crypto Winter” period, the monthly range of the Index has been around 3000. The current range of 1342.61 indicates that OKEx BTCUSD Index potentially still has room to maneuver further up or down before the year, and the question is, in which direction.

You can read more about how to utilize the monthly range numbers here.

Figure 2: OKEx BTCUSD Index Daily Chart

Table 1: OKEx BTCUSD Index Monthly Ranges

Mixed Data

Data-wise, we’ve seen a mixed bag here. Figure 3 shows that OKEx BTC perpetual funding rate remained in the negative area. While we understand a negative funding rate means that shorts pay longs in perpetual trading, it could also mean that there could be more upside in the price.

Moreover, we noticed that the Crypto Fear & Greed Index remained at a relatively low level after the rebound occurred. The Fear & Greed Index dropped to 15 on Wednesday and stayed at 21 after the overnight rebound. Although 21 may not be the lowest, still, the Index continues to stay at the “Fear” level. The reading indicates that investors could be too worried about the crypto market, and this is often considered a sign of incoming bullishness.

Figure 3: OKEx BTC Perp. Swaps Funding Rate

Figure 4: Crypto Fear & Greed Index

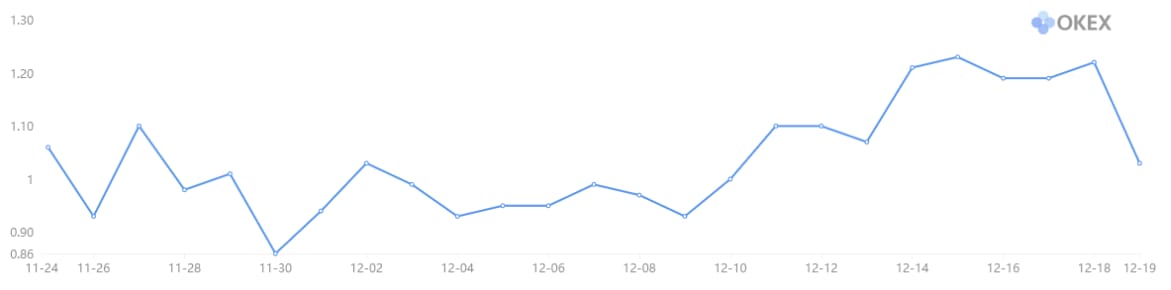

The OKEx BTC Long/Short Ratio may be another piece of the puzzle here. The ratio has retreated from 1.22 to 1.03 after the overnight price rebound, indicating that the potential profits of shorts are reduced. A lower ratio is often considered a sign of short-term price rebound.Figure 5: OKEx BTC Long/Short Ratio

On the other hand, we’ve seen that some of the institutional investors may have started to close their books as the holiday season approaches. Data from Skew shows the decline in open interest in both CME and Bakkt Bitcoin futures after BTC prices rebounded to 7200 levels.

Figure 6: CME Bitcoin Futures Total OI

Figure 7: Bakkt Bitcoin Futures Total OI

It makes sense that money managers were closing out books for the end of the year in anticipation of finalizing their portfolios. The lower open interest could imply fewer price fluctuations in the short term, and it could also suggest the increased likelihood of prices stalling at current levels.

Conclusion

The post-rebound market remains highly liquid despite a slower-than-usual market due to the holiday factor. That’s why the upcoming developments, such as changes in metrics and trends, are especially important.

This post originally appeared on Medium. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Featured image: Shutterstock/Creativa Images

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

The post Crypto Traders: Entering Decisive Zone for Short-Term BTC Price Implication appeared first on The Daily Hodl.