HodlX Guest Post Submit Your Post

This tool helps you balance the risk vs. reward of your portfolio.

Crypto traders are no stranger to risk and volatility. We all know that cryptocurrency price fluctuations could be immense. Realizing how much risk one should take on or off the table is essentially important when it comes to making trading decisions and strategies. The Sharpe ratio is a tool that enables investors to examine the overall risk-adjusted return of a portfolio or an asset. It has been widely used in traditional financial markets. Now more crypto traders have adopted this mechanism and have a better understanding of how much risk to take.

What is the Sharpe Ratio?

The Sharpe ratio indicates how well an investment performs in comparison to the rate of return on a risk-free investment, such as US treasury bonds. It is a method developed by the economist William Sharpe. It can be calculated by this formula:

where:

Rp is the expected return on the asset or portfolio.

Rf is the risk-free rate of return.

op is the standard deviation of returns (the risk) of the asset or portfolio.

How to interpret a Sharpe ratio?

A ratio higher than 1.0 is considered acceptable.

A ratio higher than 2.0 is considered as very good.

A ratio of 3.0 or higher is considered excellent.

A ratio under 1.0 is considered suboptimal.

Negative Sharpe ratio means the risk-free rate is greater than the portfolio’s return, or the portfolio’s return is expected to be negative.

Crypto’s Sharpe ratio

As of August 15, 2019, out of the major OKEx-listed coins and tokens, IOST and BSV both have a 30-day Sharpe ratio that is above 1.0. The figure above shows that IOST’s 30-day Sharpe ratio stands at 2.52; however, the 90-day ratio is negative, which could indicate IOST has a higher risk compared to other assets, but at the same time, it provided a higher return. The daily chart of IOST/USDT (below) suggested that the pair seems initially stabilized after the selloff in mid-July.

Using the table above, we see BSV and BTC both have relatively good Sharpe ratios. BSV’s 30-day Sharpe ratio stood at 1.59, and 90-day at 2.65. Meanwhile, BTC’s ratios were just behind. Its 30 and 90-day Sharpe ratios were at 0.53 and 1.87 respectively. If we compared the 90-day performances of BSV, BTC with XRP, where XRP has a negative Sharpe ratio, it looks like we have a clear winner.

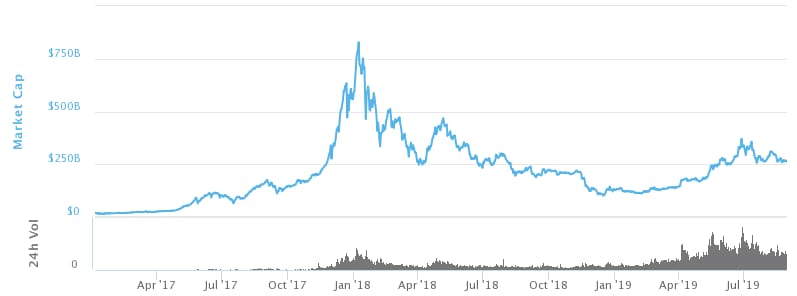

It’s another interesting picture when we do a cross-asset risk-adjusted returns comparison, and obviously, BTC has been ahead of the game for years.

Bitcoin has been giving a higher risk-adjusted return than other major asset classes. Bitcoin’s 4-year Sharpe ratio has been constantly above 2.0, and it has reached above 3.0 in 2019. At the same time, the recent rally in gold prices has made its Sharpe ratio back to around 1.3 level. On the other hand, bonds and EMFXs were in the negative area.

Aleh Tsyvinski, an economist and currently the Arthur M. Okun professor of economics at Yale University, published a research piece about risks and returns of cryptocurrency. Tsyvinski noticed that cryptocurrencies usually have a higher Sharpe ratio when compared to traditional bonds and stocks. It indicates that cryptocurrencies did not just have greater volatility, but the investment is worth it because it can generate higher returns.

Conclusion

The Sharpe ratio helps traders and investors to determine which investment has the highest returns while considering risk. However, it doesn’t provide much information in terms of price movement and prediction. Rather, it’s a supporting tool to evaluate the risk/return in a portfolio. This is especially important for participants in cryptocurrency markets where investors often face unpredictable volatility.

This post originally appeared on Medium. Read more.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

About OKEx

OKEx is a world-leading digital asset exchange headquartered in Malta, offering comprehensive digital assets trading services including token trading, futures trading, perpetual swap trading and index tracker to global traders with blockchain technology. Currently, the exchange offers over 400 token and futures trading pairs enabling users to optimize their strategies.

Follow us on Twitter.

Check our latest press material on Press Room.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

The post Crypto and the Sharpe Ratio to Evaluate Risk appeared first on The Daily Hodl.