[the_ad id="93550"]

Bitcoin trading is soaring in South Africa.

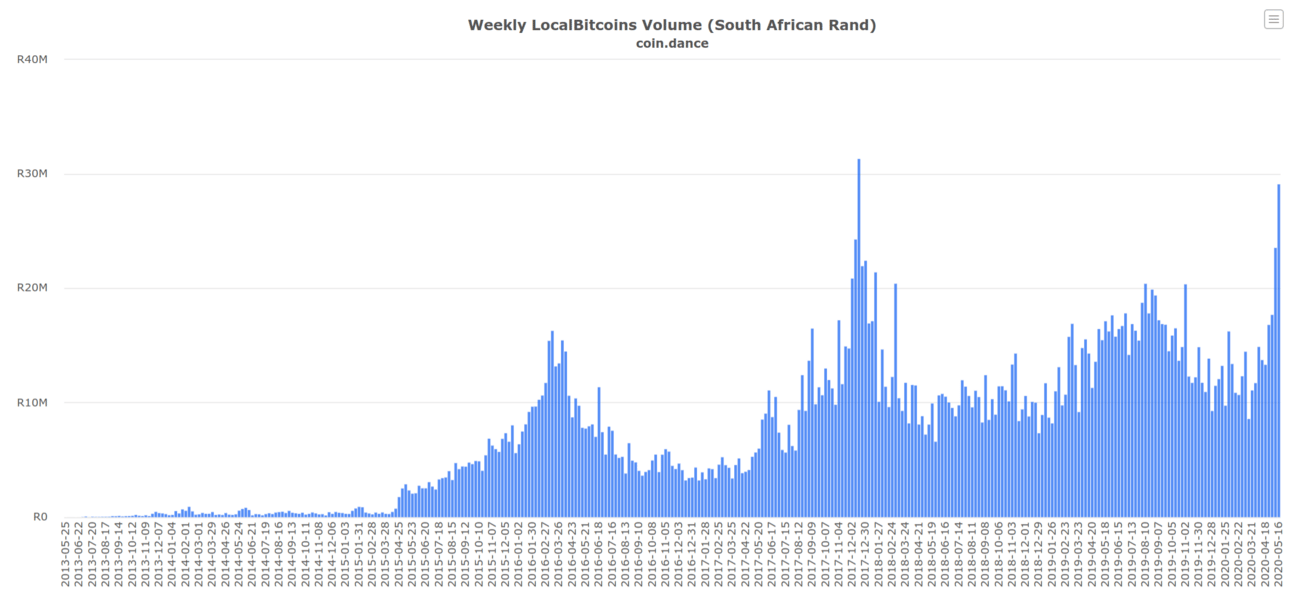

According to data compiled by Coin.dance, Bitcoin trading for the rand has more than doubled on the peer-to-peer crypto trading platform LocalBitcoins in the last month, posting its highest volume on record since December of 2017, when BTC began its last bull run.

BTC is big in Africa. Nigeria tops the list in terms of worldwide searches for Bitcoin on Google Trends, with South Africa, Ghana and Kenya rounding out the top 20, at 4th, 5th and 17th respectively.

Cryptocurrency exchange Luno has identified Kenya and Ghana as key areas for expansion following a surge in transaction volume on the South African-based exchange. With interest in Bitcoin, Ethereum and other leading cryptocurrencies increasing in the wake of the global pandemic, Luno has recently added one million new users.

Luno general manager Marius Reitz tells Bloomberg that the platform now has four million users after growing its initial base from South Africa and Nigeria, and then opening operations in Zambia and Uganda.

Says Reitz,

“It’s markets we have a keen interest in, and Ghana and Kenya are high on our list.”

Currently trading at $9,092, Bitcoin is up over 26% since the start of the year when it was trading at $7,200, and has more than doubled since plunging to $4,106 in mid-March. Despite the high volatility, the leading cryptocurrency is driving demand around the world for digital assets as economies struggle to navigate the coronavirus pandemic with investors hedging against local currencies that remain vulnerable to collapse.

The South African rand has depreciated 23% against the US dollar this year. It recently rallied to a five-week high on expectations that the central bank would cut rates again. The Reserve Bank confirmed the rate cut on Thursday to resuscitate the economy, lowering it to 3.75%. The central bank has now lowered the rate by a total of 200 basis points over the past two months of the coronavirus outbreak.

[the_ad id="95413"]

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

The post Bitcoin Trading Soars in South Africa As Transactions Double on Top Crypto Platform LocalBitcoins appeared first on The Daily Hodl.