Popular on-chain analyst Willy Woo is predicting that Bitcoin (BTC) will ultimately hit a massive value for one key reason.

Woo tells his 1.1 million followers on the social media platform X that Bitcoin could capture 3% of the total wealth assets and soar more than 975% from the current value.

“Nobody knows what the ultimate price of Bitcoin will be but simple maths can give us an upper bound. All wealth assets is $500 trillion. If BTC captured all of this (never going to happen) it’s $24 million per coin (today’s value before future inflation adjustment). The question is what will be the realistic allocation for everyone? Wealth management is very predictable, and money flows in a conservative manner according to known wisdom. BTC, even in this early phase of an asset class, Fidelity recommends 1%-3% allocation, while we have seen numbers as high as 85% from BlackRock. If we assume 3% as a sensible allocation then the lower bound of valuation is $700,000.”

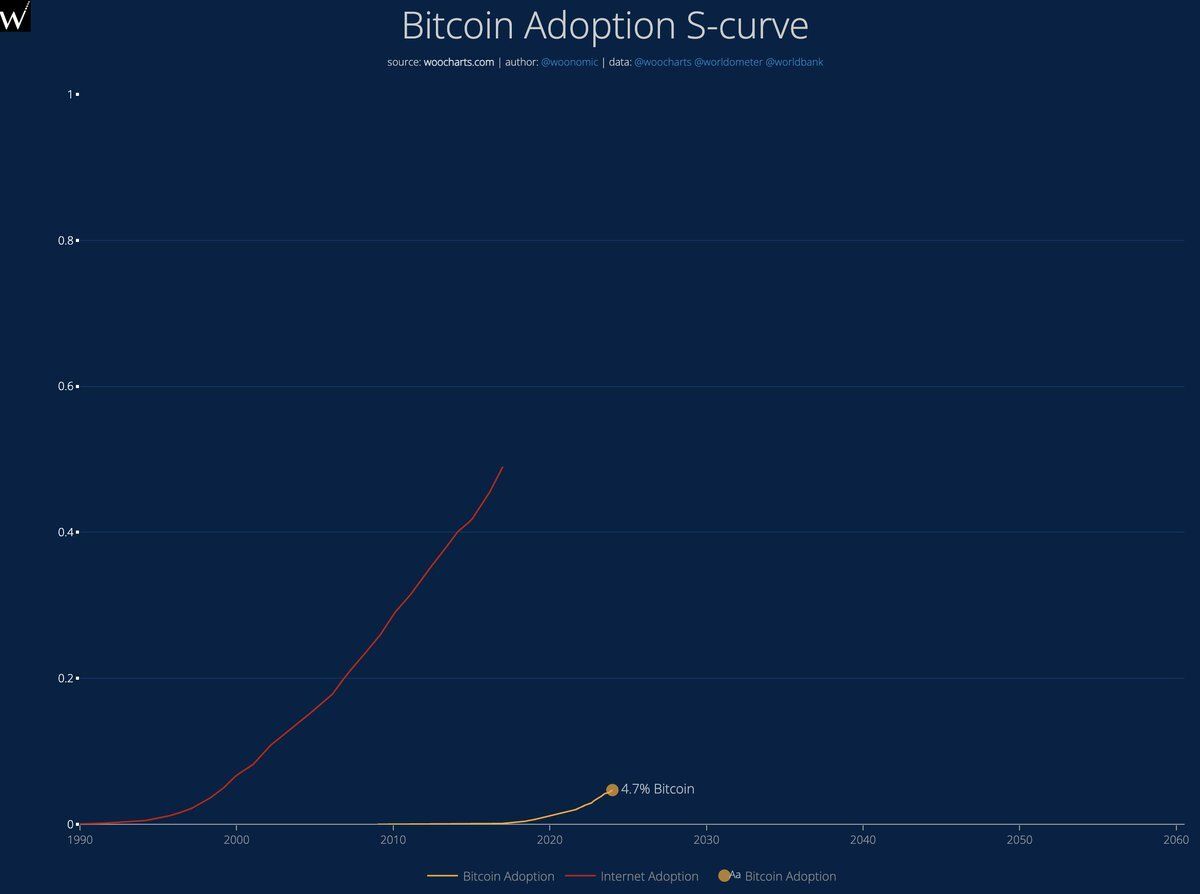

Woo believes Bitcoin will hit the six-figure price target once global adoption reaches somewhere between 16% and 50%. He says current Bitcoin adoption is at 4.7%.

“So now everyone is asking when. This is also a well-known phenomenon via the adoption S-curve. 16% is early majority, 50% is late majority. Wealth management is somewhere in this sector. So figure out when BTC adoption enters 16%-50% world adoption based on the yellow line.”

Woo shares an adoption s-curve chart comparing the asset to the Internet’s adoption rate. The adoption s-curve is often used to track the cumulative rate at which people adopt breakthrough technologies.

Lastly, Woo says that Bitcoin’s market cap could eventually exceed all fiat currencies and prompt investors to look for alternative higher-performing investments at that point.

“Once the price produces a market cap exceeding all the fiat in the world you won’t be interested in ultimate price. That’s a fiat mindset based on current realities. After this inflection point, you’ll only be looking for investments that can beat BTC. For starters, these are companies that store their profits in BTC. [MicroStrategy founder and executive chairman Michael Saylor] was the first public company CEO to figure this out, but a lot more coming.”

Bitcoin is trading for $65,096 at time of writing, up slightly in the last 24 hours.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3