The CEO of blockchain database startup Messari says there’s a huge amount of crypto capital sitting on the sidelines, ready to move into Bitcoin, Ethereum, XRP and the greater altcoin markets.

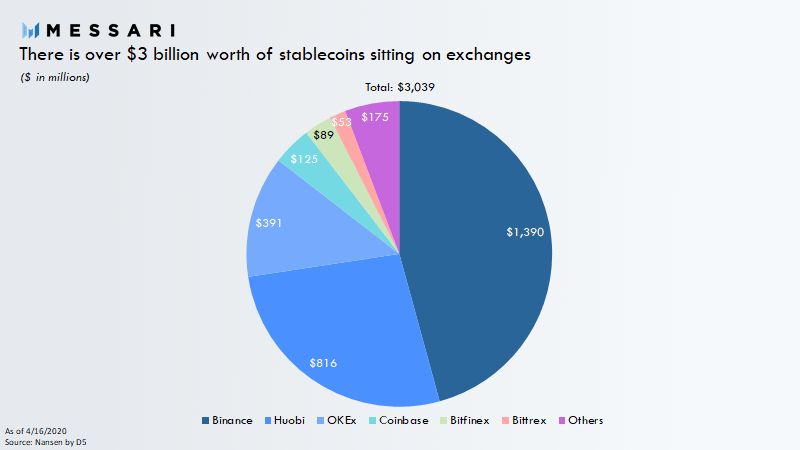

Ryan Selkis cites new data that shows cryptocurrency exchanges are now holding over $3 billion in stablecoins on behalf of their customers.

He says these investors are in a strategic position to re-enter the speculative crypto market at a moment’s notice.

[the_ad id="93550"]

“There’s now $3 billion++ of stablecoins sitting on exchanges. If investors wanted to cash out of crypto completely, they would have withdrawn funds to banks. Instead, we’ve got more dry powder held in the crypto economy than ever before. In both real and market cap % terms.”

Stablecoins are digital currencies that are pegged to traditional assets like fiat. They’re designed to hold a steady value and offer crypto traders an easy way to escape the high volatility of the crypto markets.

Back in November, Binance Research published a report on the habits of 69 high-net-worth customers with crypto allocations ranging from $100,000 to $25 million.

The survey found that 96% of those investors are utilizing the stablecoin market, with Tether (USDT) ranking as the top stablecoin by a wide margin. ??

“Despite its ongoing legal issue being considered one of the most significant risks for the industry, USD Tether (USDT) remained the most widely used stablecoin (40%), for reasons quoted such as greater liquidity and higher market capitalization than its peers.

While alternative options are also being used, stablecoins backed by exchanges, like USDC (Coinbase, Circle) and BUSD (Binance), seemed to spark more prominent interest from many respondents than other (than USDT) fiat-backed competitors.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/FabrikaSimf

The post $3,000,000,000 in ‘Dry Powder’ Poised to Enter Bitcoin (BTC) and Cryptocurrency Markets: Messari CEO appeared first on The Daily Hodl.